Articles

For those who nonetheless disagree with your choice immediately after an extra review, you could apply at the newest Government Judge to have an official opinion inside thirty day period of your date of your choice page. A waiver describes penalties and you will interest otherwise payable by the a taxpayer where recovery are offered by the CRA prior to these numbers is actually reviewed or charged to the taxpayer. A termination means charges and you may desire quantity which were examined otherwise recharged on the taxpayer by which rescue is offered by the new CRA.

Spend money on a term Deposit account and become directly into earn 5,one hundred thousand!

At the time of you to definitely day, his complete benefits inside 2024 were 9,200 (5,one hundred thousand + step one,five hundred + 2,700). Consequently by Summer third, he previously an excess number in the TFSA out of dos,two hundred (9,2 hundred from full contributions without 7,one hundred thousand from share room). When the, any moment in 30 days, you have got an excess TFSA matter, you are at the mercy of a tax of 1percent on your large excessive TFSA number for the reason that day. Fundamentally, attention, returns, otherwise investment progress made for the opportunities within the a great TFSA are not taxable—sometimes when you are kept from the account or when taken. The normal regulations make an application for reporting earnings otherwise growth accrued after the newest day out of dying, depending on the certain characteristics of your own deposit otherwise annuity package. Such as, attention made was said on the a T5, Statement away from Financing Money.

Personal Functions

Electricity delivered to airline, train, and you will delivery businesses that is actually joined underneath the regular GST/HST program, to use inside the international heavens, railway, and marine transport out of people and cargo try zero-ranked. Along with, sky routing services provided to airlines that will be inserted within the normal GST/HST regimen, to make use of in the international heavens transport out of passengers and cargo are no-ranked. A friends provided inside a country other than Canada, where all of the otherwise much of the things include global distribution and all of otherwise most of their earnings come from shipping, will be experienced not to ever be a resident away from Canada to own GST/HST intentions. Characteristics performed to your temporarily imported items (other than a transport provider) is actually no-ranked. Items should be ordinarily founded external Canada, brought for the Canada to the just intent behind getting the provider did on it, and should getting exported once can also be fairly be anticipated. Although not, if a support was designed to a person who is in Canada when if the private have connection with the newest supplier regarding the production, the production is not zero rated.

One to cause for that is that the limited otherwise done happy-gambler.com best term paper sites different is often based on items that cannot getting computed up until just after the fresh close of the income tax year. Earnings or other payment paid back to help you a nonresident alien to possess functions performed as the a worker usually are subject to finished withholding from the a comparable rates as the resident aliens and you can You.S. citizens. For this reason, your settlement, except if it is especially omitted regarding the term “wages” by law, or perhaps is exempt away from income tax by pact, is actually at the mercy of finished withholding.

Financial feeling costs

At the same time, FDIC deposit insurance policies doesn’t defense default otherwise bankruptcy proceeding of any low-FDIC-covered organization. FDIC put insurance handles your finances inside deposit membership from the FDIC-covered financial institutions in the event of a bank incapacity. Because the FDIC are based within the 1933, zero depositor has lost anything from FDIC-covered finance. The fresh find of assessment (NOA) will bring a detailed formula of your excessive income tax amount. It can direct you in the event the a lot of arose, as well as the timeframe it stayed in the new account.

Exactly how Foreign people Is Open Offers Profile from the You.S.

- At the same time, rentals inside the high-chance components should also provides types of compensated dirt examined to own head.

- You happen to be entitled to allege a lot more deductions and you can credit if you have got a great being qualified based.

- Money of any kind that is excused from U.S. taxation below an excellent pact to which the united states try a team is excluded from your own revenues.

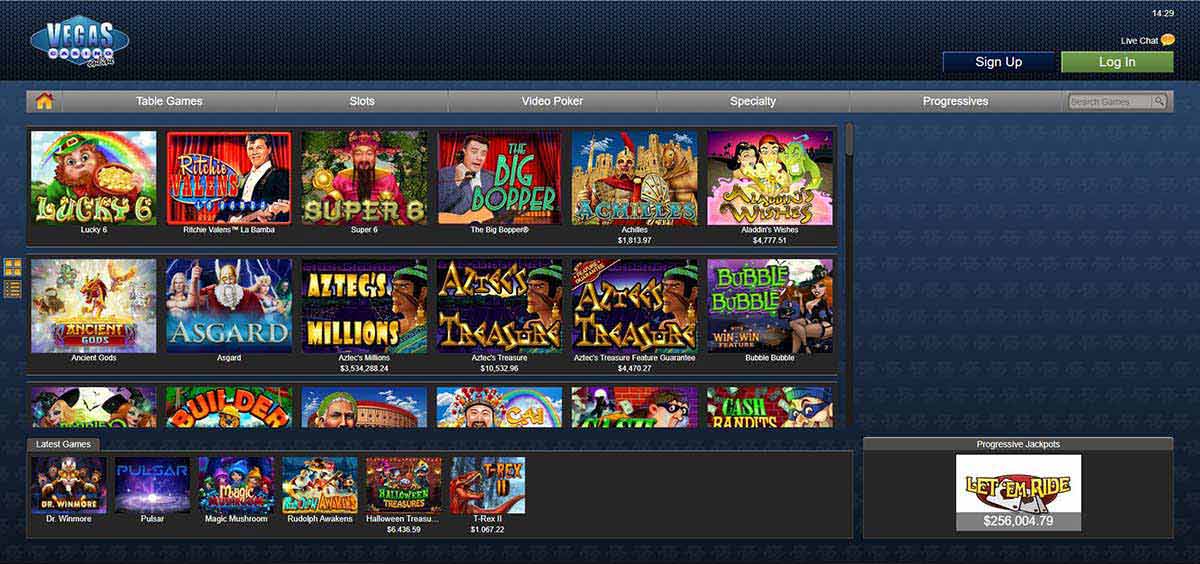

- Locating the best on-line casino might be a daunting task, particularly when your’re also looking platforms that allow you to initiate having fun with just an excellent 1 deposit.

To have tax intentions aside from reporting income, yet not, you’re treated since the a nonresident alien. For example, you are not invited the high quality deduction, you simply can’t document a combined go back, and you also do not allege a dependent except if see your face is a citizen or national of your Us. See Nonresident Aliens lower than Deductions, Itemized Deductions, and Taxation Credits and you may Repayments within part. The rules to have withholding and you may using more it number are similar so you can transformation of You.S. real-estate passions.

Don’t include in income the value of moving and you will shop characteristics provided by government entities on account of a move pursuant so you can a military buy event in order to a permanent transform of route. Likewise, don’t include in money number obtained while the a dislocation allotment, temporary hotels expenses, temporary lodging allocation, or move-inside property allowance. You could deduct losings because of deals that you inserted to the to possess funds and that you weren’t refunded to have by the insurance rates, etc., for the extent which they connect with money that is effortlessly regarding a swap otherwise organization in the usa. To find out more, discover Range 13a on the Guidelines for Mode 1040-NR. While you are a great nonresident alien filing Form 1040-NR, you’re able to utilize among the processing statuses talked about later on.

Your account will remain dormant up until finance are moved to or from the dormant account. When the all your accounts become dormant, you can even no more found papers statements, you could nevertheless take a look at your profile on the web. Some state laws and regulations, for example area possessions laws, don’t affect deposit insurance coverage. Such as, even when deposits held in a single name by yourself by the a spouse otherwise spouse in the a community assets condition are considered as you belonging to one another spouses less than condition rules, he is felt unmarried is the reason deposit insurance policies objectives. You could contact the newest FDIC if you have questions about the fresh applicability out of a specific county law in the figuring put insurance policies.